Articles

Washington (AP) — The newest Biden administration would like to build domestic home deals far more clear because of the unmasking proprietors away from particular all-dollars sales. It’s section of an ongoing energy to battle money laundering and you may the brand new way from filthy money from the American financial system. Company of your own Treasury and county banking bodies to include the clients that have a safe, safe fee provider. The firm have released the new securities, funded the cash supplies, used money laundering identification systems, based OFAC examination, and completed the newest banking control and you can economic audits to perform since the a non-financial lender.

Starting out within the commercial a house

For many who wear’t has a https://happy-gambler.com/mayana/ checking account, check out Internal revenue service.gov/DirectDeposit for additional info on where to find a financial otherwise credit union which can unlock a free account on the web. You could prepare the newest income tax go back oneself, find out if you qualify for 100 percent free taxation thinking, or hire a tax professional to arrange their come back. An excellent blanket withholding certificate can be provided if the transferor holding the new USRPI provides an enthusiastic irrevocable page from borrowing or a hope and switches into a taxation percentage and you can shelter agreement to the Irs.

Invest in Single-Family members House

Inside a scene where time issues, locating the best provider can alter everything you. An option disadvantage of an excellent REIT would be the fact it will spreading no less than 90% of its nonexempt earnings as the dividends, and that limits its ability to reinvest profits to have growth. This will constrain a lot of time-term financing enjoy than the other holds. An alternative choice to have committing to home-based REITs would be to purchase an ETF one to spends within the home-based REIT brings.

The following sort of income received from the a different bodies try susceptible to section step three withholding. A secure expatriate need offered you having Mode W-8CE notifying your of the protected expatriate status plus the fact that they’ll getting at the mercy of special taxation laws and regulations relating to particular things. “Willfully” in cases like this function willingly, knowingly, and you will intentionally. You are pretending willfully for those who spend almost every other costs of the business instead of the withholding taxes. Such as, if the a trust will pay earnings, including certain kinds of retirement benefits, supplemental jobless shell out, otherwise resigned spend, and the individual to own which the support were performed doesn’t have legal control over the fresh commission of one’s wages, the fresh trust is the workplace.

Commercial property finance tend to be rather tight and may wanted that you tell you an optimistic track record that have residential home basic, at the top of getting more income down. It’s along with a good riskier investment, as it can be more complicated to get clients, and you will commercial services will become influenced by terrible economic climates. The majority of people searching for college student a house investing get started with belongings, and for valid reason. The brand new hindrance to admission is leaner each other economically and in conditions of experience height. Off repayments try rather smaller, and you will particular consumers may even be eligible for downpayment guidance software you to aren’t available for commercial a house. What’s more, it’s normally much easier to be eligible for home financing than simply a commercial mortgage loan.

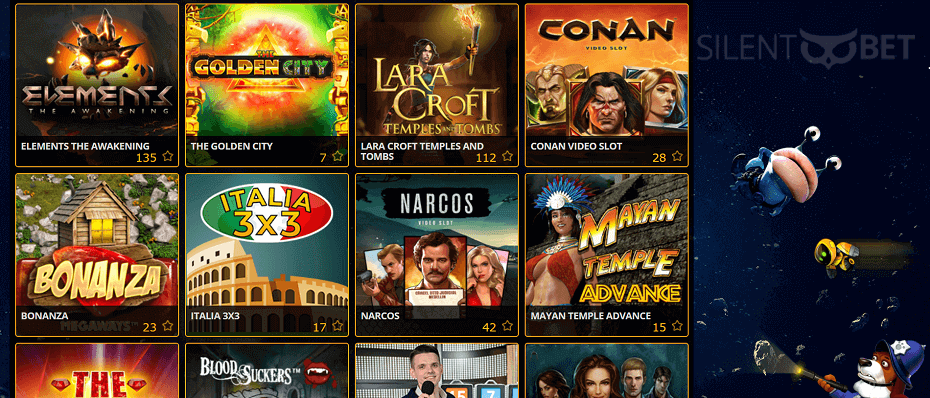

There should be a balance between what is being offered since the a plus and you can what you need to do in order to turn you to definitely extra for the real money. We Listing Just the Subscribed OperatorsAll web based poker websites the next features become registered and you can certified by the designated jurisdictions and you may authorities, guaranteeing the protection, legality, and you will equity of them web sites as well as their poker game. In addition, i research the reputation for these sites to ensure people are happy for the services given and treatment. Merely if we ensure that the webpages clicks the right boxes can we establish they here.

Withholding international partnerships and withholding foreign trusts aren’t circulate-due to entities. A payer documents a tax come back on the Form 945 to help you declaration copy withholding. A good U.S. relationship will be keep back whenever people withdrawals that include number subject to withholding are designed. You could turn empty bed room your self property to the local rental areas also known as accessory dwelling systems. By the updating the cellar, lost, and other place to the a livable equipment, you could potentially attract book-paying tenants. You also can also be make a guest house since the an ADU when the you may have enough free space to your possessions you already individual.

Genisys Borrowing from the bank Relationship *

Treasury was also guilty of undertaking almost every other openness-related effort, like the rollout away from another databases on the business control. The fresh therefore-entitled helpful ownership registry is expected so you can contain personal information for the proprietors of at least 32 million U.S. businesses. You to definitely study from the brand new effect of cash laundering on the home values inside Canada, conducted because of the several Canadian academics, found that money laundering investment inside a property pushed up housing cost in the directory of 3.7% so you can 7.5%. A house try a commonly used car for cash laundering, due to opaque reporting regulations to your purchases.

Businesses from the home business would be to get ready for the new execution of this latest code because of the evaluating the current AML strategies, identifying opportunities that may result in revealing personal debt, and establishing ways to comply with the brand new conditions. FinCEN has awarded Faqs to help stakeholders browse the new rule’s complexities. Because it’s supported by brick and mortar, lead home and carries reduced principal-representative disagreement or even the extent to which the interest of your own trader will be based upon the brand new stability and you will ability out of executives and you can debtors.

However with all of the different says enabling various other workers, some thing can get a tiny dirty on the uninitiated casino poker professionals in the us. Such as typical dividend-paying holds, REITs is a solid funding to own buyers which seek normal income. On the and front side, since the possessions begins presenting dollars, it could be leveraged to locate a lot more property. Slowly, the brand new investor can buy lots of earnings channels out of several services, offsetting unexpected can cost you and you will losings which have the new earnings.

Unsecured Business Loan

A battled inside the 2008 overall economy, then noted REITs answered if you are paying of loans and re also-equitizing the harmony sheets by the offering stock for money. Detailed REITs and you can REOCs increased $37.5 billion within the 91 secondary guarantee products, nine IPOs and you can 37 unsecured debt offerings since the buyers proceeded to help you work favorably to help you companies strengthening its harmony sheets following credit crisis. A partnership are a “resident” away from Maine in the event the at the least 75% of your control of these connection are kept because of the Maine citizens.

A great You.S. believe is required to withhold for the count includible from the revenues of a foreign recipient on the the amount the fresh trust’s distributable net gain consists of an expense subject to withholding. For the extent a You.S. trust must spreading an amount susceptible to withholding but cannot indeed distribute the quantity, it should withhold to the international beneficiary’s allocable show at the day the cash is needed to be claimed for the Setting 1042-S. When the an expense subject to part step three withholding is even a good withholdable commission and you will part 4 withholding is placed on the new commission, zero withholding is needed under part 3. Sobrato been attempting to sell house inside Palo Alto while the a student in the Santa Clara University, ultimately getting into developing commercial features next to their mommy ahead of beginning the brand new Sobrato Team inside 1979.